Give Land

Give Land, Farm, or other Real Estate

Create Land Legacy

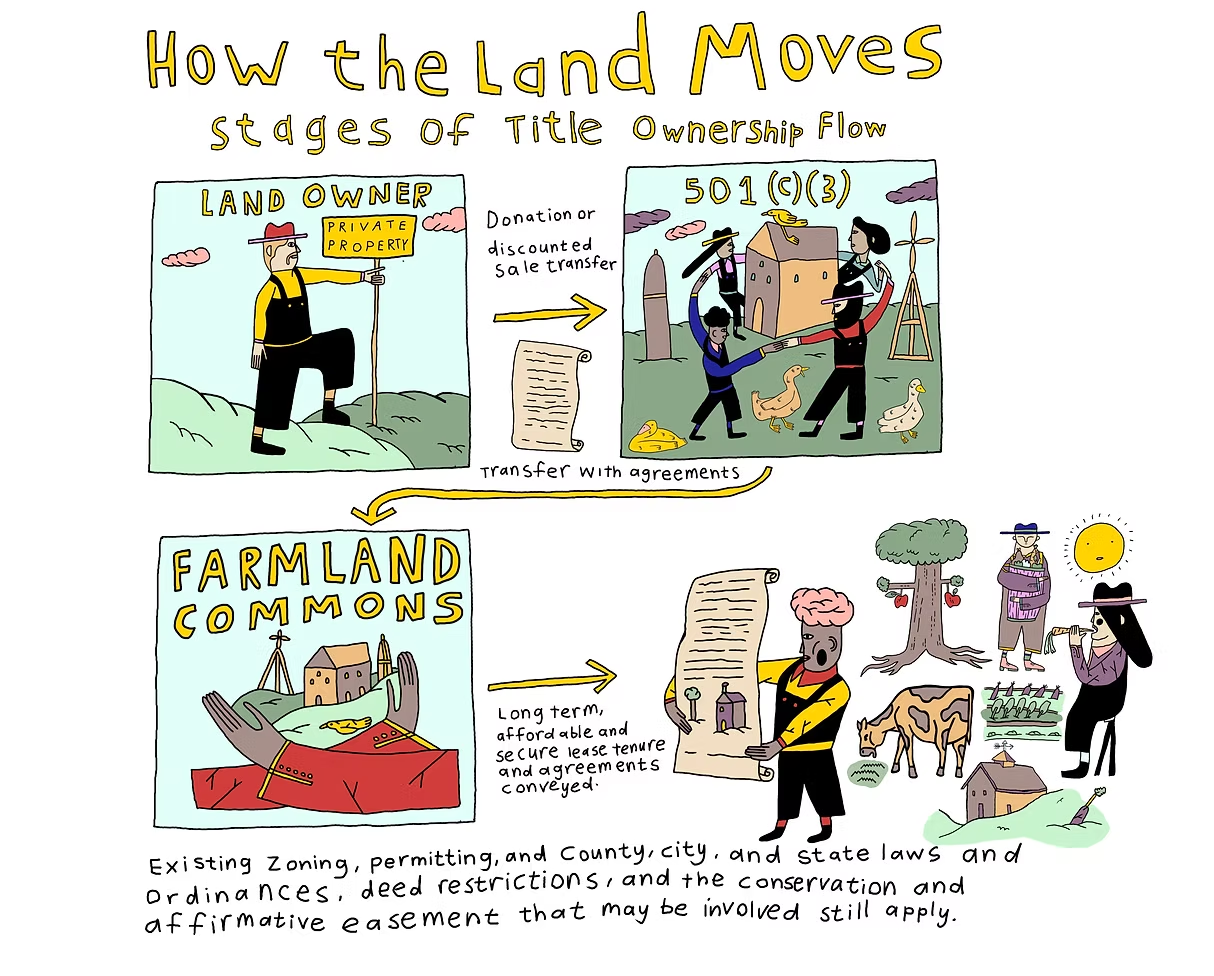

Donating your farmland, farm, or other real estate for food, agriculture, community, ecosystem health, farm business viability and land justice through the Farmland Commons is one of the most impactful and transformative legacies a person can leave to the future.

For decades, contributing land for conservation has been one way to create a legacy for the future. The Farmers Land Trust expands upon this model and land trust movement to also protect land for agriculture. Our unique approach provides a way to preserve land beyond conservation, and includes current and future

Gifting farmland, farm, or other real estate to the Farmland Commons to decommodify the land and place it in community control to be used for regenerative agriculture by people who would not be able to have access and tenure to land otherwise is a powerful way to create systematic change that benefits land, people, and Earth.

If you want to learn more or are ready to move forward with a land donation to the innovative and inspiring Farmland Commons, The Farmers Land Trust will work with you. Together, we will identify the best options and paths forward to address the protection, use, and stewardship of the land. This gift will provide equity, power, and access to young and beginning farmers and communities that have been systematically displaced, who are ready and eager to be in reunion with the land.

Your consideration to create a new kind of legacy for generations to come for the benefit of land, people, agriculture, and community through The Farmers Land Trust will ensure that your land is held as a community asset in perpetuity with a dedication to stewardship, ensuring ecologically-sound food, fiber, and medicine production agriculture, and securing access and affordability to current and next generation farmers.

You have held ownership, carried out stewardship, farmed, invested all forms of capital into, and shared relationships with the land, and you now have the opportunity and responsibility to determine the future of this land. There are many pathways to create land legacy, and The Farmers Land Trust brings trusted wisdom, passion, care, and experience forward to support learning and action as together we create the land legacy that is right for you.

Farmland, farms, and other real estate can be donated to the Farmland Commons through The Farmers Land Trust, with other real estate considered within farm and food systems needs, or as a resale to fund the Farmland Commons. The Farmers Land Trust accepts farmable and non-farmable land entirely to support the Farmland Commons.

The interested landowner(s) must have control of the title. If there are other people on the title, all must agree to the gift. In addition, any debts or liens will need to be satisfied during the process. Time frame can be 3-12 months or more, depending on landowner readiness to act, key documents, and complexity of the transaction.

A Land, Farm, or other Real Estate Donation is Possible in the Following Ways:

Full Donation

A Full Donation is the conveyance of full interest in ownership of farmland, farm, or other real estate through deed to The Farmers Land Trust.

- Review information on our website and other resources you find, spend time thinking about, and make a commitment to move forward to learn more

- Contact us for a conversation/s to share, discuss options, have your questions answered, and gain an understanding of available options available and the path forward

- Send us your thoughts, vision, goals, and information, mapping, and data on the farmland, farm, or other real estate

- We collaborate to obtain:

- Title Examination: Review property records to ensure legal right to convey the understanding of how to satisfy and/or manage liens, easement, or clouds affecting the title

- Assessment: Verify the condition of the land and all buildings and infrastructure, including structural, mechanical, and environmental aspects

- Survey and Boundary assessment: Verify property lines and boundaries to ensure they match the legal description and don't encroach or have encroachments

- Zoning and Land-Use Analysis: Check zoning laws, land use regulations, and restrictions to understand how the property can be used in all ways intended

- Collaborative creation of contractual agreement

- We visit for an Initial land or farm walk, observation, and connection

- Farmland Commons Committee Review, Evaluation, Discussion, and Decision to proceed; based on:

- Due diligence

- Maps, photographs, farm, forest, and land management plans, maintenance and/or stewardship records and other information

- Financial Due Diligence: Reviewing financial records of:

- farm for viability consideration

- tax assessments, utility costs, insurance costs, and carrying costs

- Due diligence

-

-

- Environmental Assessment: Assessing potential environmental risks and/or liabilities, such as contamination or hazardous materials

- Permits and Approvals: Verifying that all necessary permits for renovations, additions, or land use have been obtained and are in compliance with local regulations

- Insurance Review: Evaluating insurance coverage for the property to understand any limitations or risks

- Community Analysis: Assessing the local community connection to this land

- Utilities and Infrastructure Check: Confirming the condition and accessibility of utilities (water, sewer, electricity, etc.) and assessing the overall infrastructure of the property

- Risk Assessment: Identifying and evaluating any potential risks associated with the property, such as legal, financial and/or market risks

- Fundraising Outreach and Community Engagement Campaign

- Next Generation Farmer Outreach and Engagement Campaign

-

- The Farmers Land Trust Board Approval

- Appraisal valuation of the farmland, farm, or other real estate to be completed and timed to date of transfer for gifting landowner tax benefits

- Closing occurs when deed is signed, notarized, and recorded with Town Clerk

- Continued Next Generation Farmer Campaign

- Active stewardship of the farmland or farm - or - development of a transfer plan to convert other real estate to capital to support Farmland Commons

The time frame can be 3-12 months or more, depending on landowner readiness to act, key documents, and complexity of the transaction.

The Farmers Land Trust is available to craft the best approach for you, your family, your land and your legacy.

Please contact us with any questions you may have by emailing [email protected].

A Remainder Interest with Life Estate

A remainder interest with a life estate is a great option for those who want to live their remaining days on their farm or allow family members this right. This Full Donation, with option or right of certain individuals to hold life estate give them the legal rights to possess and use the agreed upon buildings and areas of the property during their lifetime. Upon the death of those individuals named , the property in its entirety passes into the Farmland Commons, without the need for probate. A Life Estate is usually created through a deed, but can be created in a will or a trust

Bequest

The most common form of a planned gift is a bequest of one or several of the below options. Please contact us to discuss and then please provide copy of all documents that describe and conveys bequest:

- List The Farmers Land Trust, Inc as the beneficiary in your Will or Living Trust of owned farmland, farm, or other real estate.

- List The Farmers Land Trust, Inc.as a beneficiary for a fixed amount or a percentage of your estate.

- List The Farmers Land Trust, Inc. as a beneficiary of your life insurance or retirement accounts.

Below are examples of language that you can use in your will or trust, but we advise you to obtain the assistance of an attorney when making or revising your will.

Cash Bequest

“I bequeath the sum of $_______________ to The Farmers Land Trust, a Delaware non-stock corporation, to be used or disposed of as The Farmers Land Trust, in its sole discretion, deems appropriate.”

Bequest of Property - Personal Property

“I bequeath (describe property) to The Farmers Land Trust, a Delaware non-stock corporation, to be used or disposed of as The Farmers Land Trust in its sole discretion deems appropriate.”

Bequest of Property - Real Estate

“I devise all of my right, title, and interest in and to real estate located at (give address and describe property) to The Farmers Land Trust, a Delaware non-stock corporation, to be held as part of a Farmland Commons in the state in which land is located.”

Residuary Bequest - Share of or Entire Value of Residue of Your Estate

“I devise and bequeath (________ percent) (the entire value) of the residue of my estate to The Farmers Land Trust, a Delaware non-stock corporation, to be used or disposed of as The Farmers Land Trust in its sole discretion deems appropriate.”

Contingent Bequest

To leave the charitable organization whatever is left in the estate after the death of the primary heir(s), usually the surviving spouse, insert the conditional language into one or more of the above provisions:

“If my husband (wife) does not survive me, I bequeath the sum of $__________ to The Farmers Land Trust, a Delaware non-stock corporation, to be used or disposed of as The Farmers Land Trust in its sole discretion deems appropriate.”

Restricted Use

If the gift to The Farmers Land Trust is for a purpose other than The Farmers Land Trust’s unrestricted use, insert the restriction in place of the words “to be used or disposed of as The Farmers Land Trust in its sole discretion deems appropriate.” For example:

“I bequeath the sum of $________ to The Farmers Land Trust, a Delaware non-stock corporation, for the following use:

“i.e. the purchase of critical lands, land protection and decommodification needs, land management and stewardship, etc.”

In the event of a gift subject to a restriction, we would appreciate your consulting with us to determine if the restriction is appropriate for The Farmers Land Trust. We also suggest including one of the following provisions:

- A. “However, I impose no legal or equitable obligation in this regard.”

- B. “If in the judgment of The Farmers Land Trust it becomes, or is likely to become, impossible or impractical to accomplish the purposes of this gift, the income or principal, or both, may be used for such related purposes and in such manner as determined by The Farmers Land Trust.”

Questions?

Please contact us for discussion or if you have questions about this material or require additional information about making a provision in your will to benefit The Farmers Land Trust, please contact:

Co-Executive Director, Ian McSweeney and Co-Executive Director, Kristina Villa at [email protected], or by calling (833) 432-7658

The Farmers Land Trust is a Delaware non-stock corporation.

Estate Planning

Strategic real estate gifts can play an important role in long-term estate and legacy planning. The Farmers Land Trust is here to help you and your family explore the best approach for your land, your goals, and your legacy.

Please contact us with any questions you may have by either emailing us at [email protected] or [email protected] or scheduling a time to talk with us.